UNIT TRUST

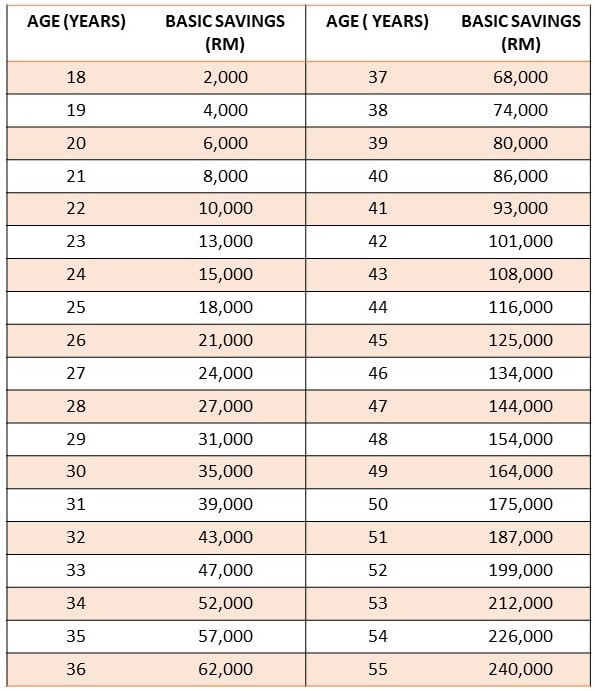

EPF BASIC SAVINGS TABLE (Effective 1 January 2019)

EPF Members' Investment Scheme

(Based on EPF Basic Savings's Table, effective 1 January 2019)

If you are at the age 22 and have RM 15,000 in your Account 1, your withdrawal amount is :

Total Savings in Account 1 RM 15,000

Less: Basic Savings in Account 1 - RM 10,000

Excess Amount RM 5,000

Investment Amount ( 30% X 5,000) RM 1,500

Subsequest withdrawal can be made after 3 months from your last withdrawal. Your new balance in Account 1 after the first withdrawal is RM 13,500 (RM 15,000 - RM 1,500. Your next withdrawal amount will be:

Total Savings in Account 1 RM 13,500*

(RM 15,000 - RM 1,500)

Less: Basic Savings in Account 1 - RM 10,000

Excess Amount RM 3,500

Investable Amount ( 30% X 3,500) RM 1,050

*Assuming no future contributions

(Based on EPF Basic Savings's Table, effective 1 January 2019)

If you are at the age 22 and have RM 15,000 in your Account 1, your withdrawal amount is :

Total Savings in Account 1 RM 15,000

Less: Basic Savings in Account 1 - RM 10,000

Excess Amount RM 5,000

Investment Amount ( 30% X 5,000) RM 1,500

Subsequest withdrawal can be made after 3 months from your last withdrawal. Your new balance in Account 1 after the first withdrawal is RM 13,500 (RM 15,000 - RM 1,500. Your next withdrawal amount will be:

Total Savings in Account 1 RM 13,500*

(RM 15,000 - RM 1,500)

Less: Basic Savings in Account 1 - RM 10,000

Excess Amount RM 3,500

Investable Amount ( 30% X 3,500) RM 1,050

*Assuming no future contributions

exsy & atventure.com.my is a service provided by AT Venture 201703043361 (SA0412081-A) ©. All rights reserved.